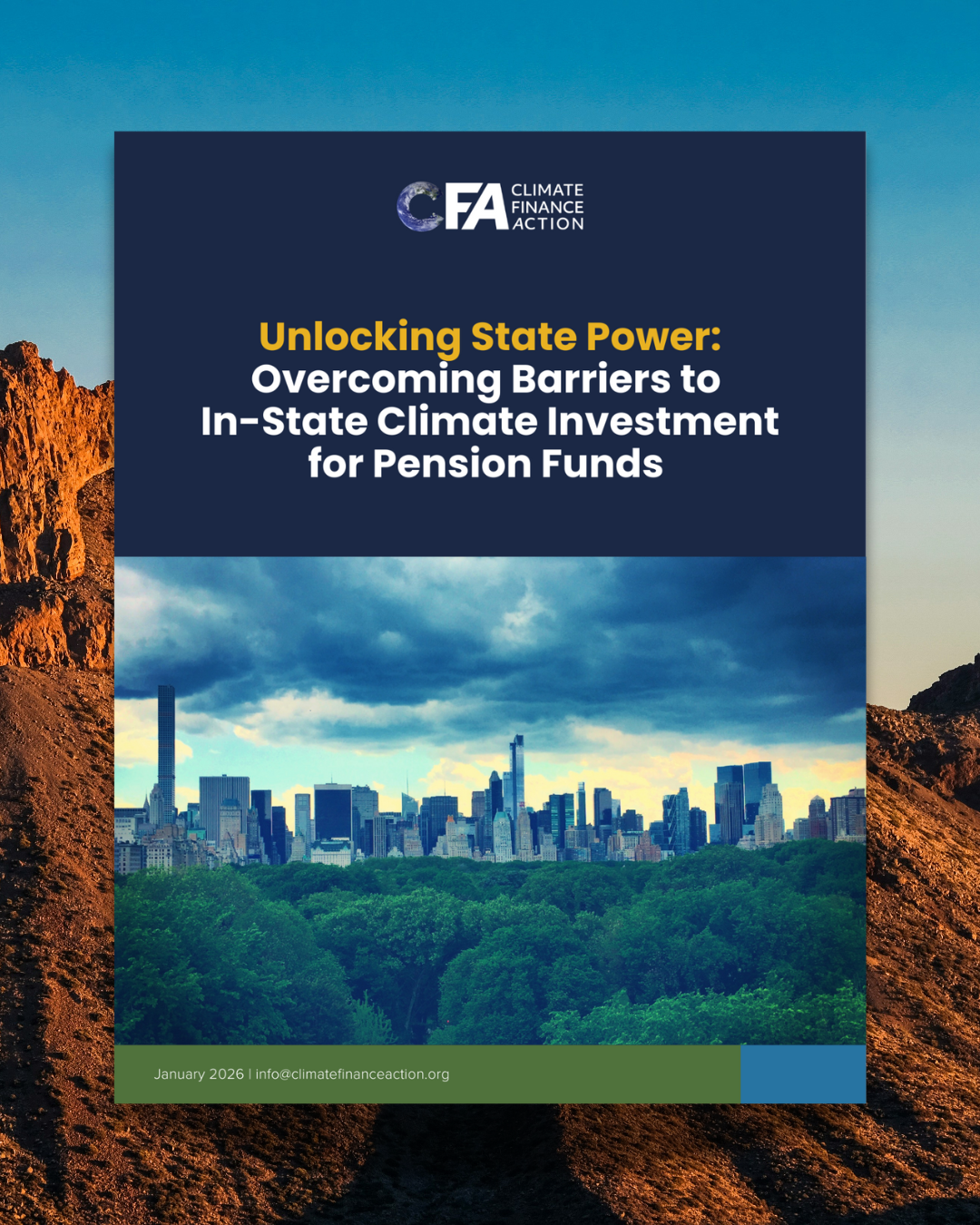

Published: January 6, 2026Unlocking State Power: Overcoming Barriers to In-State Climate Investment for Pension Funds

Climate change is more than an abstract risk; it’s a financial threat that affects the long-term stability of state infrastructure and public pension funds.

Unlocking State Power: Overcoming Barriers to In-State Climate Investment for Pension Funds highlights a clear opportunity: investing in the energy transition and in-state climate resilience, such as modern water systems, clean energy grids, and fortified infrastructure, can deliver competitive, long-term returns while strengthening the economies where beneficiaries live and work.

The challenge? Pension funds face interlocking institutional barriers that prevent these critical investments from scaling fast enough.

If you've been looking for a path forward, this is a clear place to start. Download the white paper now to explore the barriers, solutions, and actionable steps public pension funds can take to unlock in-state climate investment opportunities.

What You’ll Explore in This Paper

-

How climate and physical risks directly affect long-term fund performance and fiduciary responsibility

-

Why tools like stress-testing assets against local hazards—such as flooding or extreme heat—are essential

-

The role of climate investments in building resilience, supporting quality jobs, and stabilizing regional economies

-

The governance, staffing, and operational changes funds need to move from intent to implementation

-

Real-world examples of funds deploying capital in-state, the tools they use, and actionable steps others can adapt

Learn how state pension funds can overcome barriers and strategically deploy capital to support local economic and infrastructure modernization.