Why Integrated Resilience Matters Now: Protecting Labor’s Future in a Shifting Climate

For years, the climate conversation inside public institutions has centered on mandates, emissions targets, and compliance. State public pension funds now publish roadmaps and sustainability reports, from Maryland’s resilience plans to Washington’s investment disclosures. Yet a growing gap remains between policy on paper and economic reality on the ground.

At the same time, the role of union leaders and worker advocates is evolving.

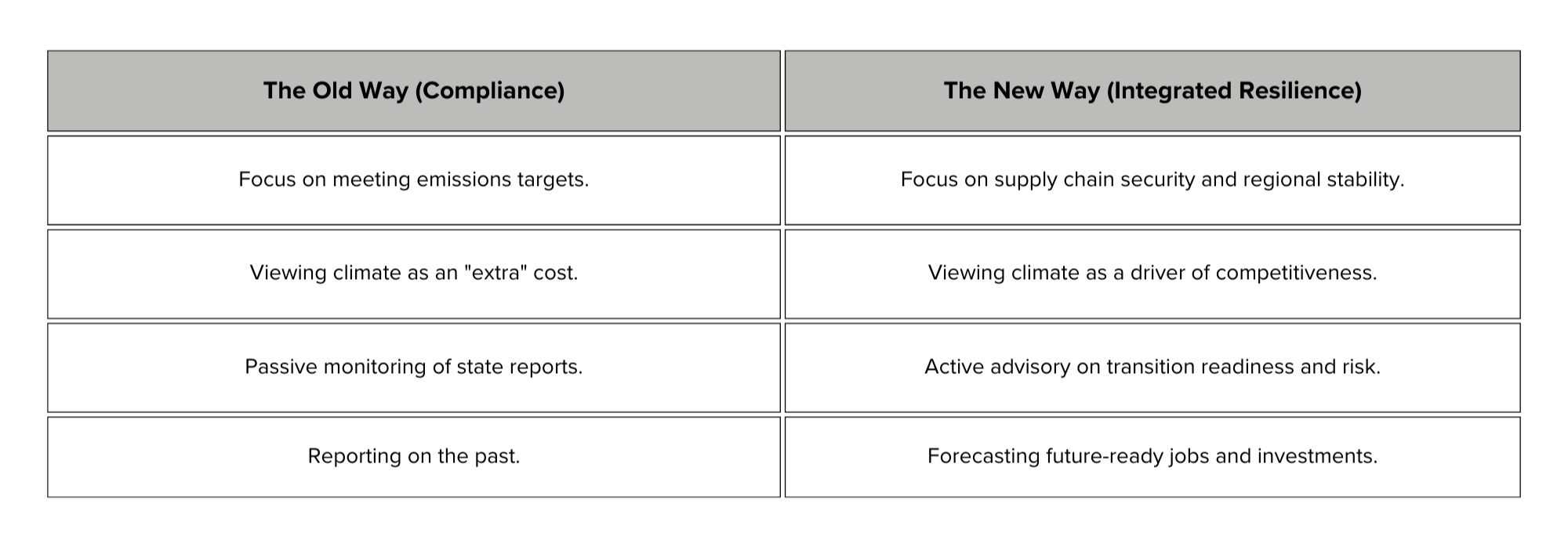

Climate-linked risk alters the very foundations of workers' livelihoods, from regional competitiveness and supply chain stability to the long-term health of pension funds and local tax bases. Simply monitoring whether a shop is “meeting code” is no longer enough. Integrated resilience is now more important than ever since compliance alone won’t protect workers’ futures.

This shift demands oversight and insight.

Insight Over Oversight

Climate change is no longer a future-facing concern or a narrow environmental issue. It is a threat multiplier for the economy, influencing where capital flows, where industries locate, and which regions remain competitive.

According to CFA’s Transition Readiness Primer, "transition readiness" is quickly becoming the benchmark for economic viability. Regions and employers that fail to prepare for the energy transition, physical risks, and supply chain disruptions will become effectively uninvestable.

When capital moves away, jobs follow. When a region fails to plan for transition, the consequences quickly emerge: deferred maintenance, stranded assets, and lost contracts.

Union members’ livelihoods depend on leaders who can anticipate these shifts before they show up as plant closures, canceled contracts, or underfunded pensions. Insight is what allows labor to stay ahead of systemic risk rather than reacting after damage is done.

Protecting the Future: Beyond Simple Disclosures

When we look at pension fund reporting, we can’t be satisfied with "green-washing" or vague sustainability goals. To protect workers’ futures, reporting must move toward meaningful accountability.

We need the granular data outlined in CFA’s 10 Key Attributes of Effective Pension Fund Reporting. At a minimum, effective reporting should answer three questions:

Asset Alignment: Are our investments positioned to thrive in a low-carbon economy, or are they anchored to the past?

Real-World Impact: How do these financial shifts affect the regional economies where our members live?

Accountability: If a fund claims to be "transitioning," where is the proof in the portfolio?

Climate risk is financial risk. Without clear answers to these questions, trustees and beneficiaries are left navigating blind spots that can quietly erode long-term security.

Our Framework: Integrated Resilience

To meet this moment, CFA is building an advisory framework designed to help leaders navigate these interconnected risks, moving beyond what is disclosed to what is actually changing on the ground.

Using tools like the Checklist for Policy Implementation and Accountability, we help leaders connect governance, investment strategy, and real-world outcomes. The goal is to align decision-making with economic reality.

This shift allows labor leaders to engage earlier and influence outcomes before capital is misallocated or risks become irreversible.

Turning Transition into Long-Term Stability

The purpose of this work is not just to be "green." It is to ensure that union labor remains the backbone of a stable, competitive, and resilient economy.

There is a broad consensus that climate change is already affecting markets. The only open question is whether workers and their representatives help shape transition planning or are forced to respond after decisions have been made elsewhere. By focusing on transition planning, accountability, and integrated resilience, we ensure that workers, union leaders, and decision-makers can move from reacting to risk toward actively positioning all stakeholders for long-term security.

When state roadmaps are finally implemented, members should be driving the vehicle. This will be the evidence of an effective shift from being the subjects of climate policy to being the architects of economic resilience.